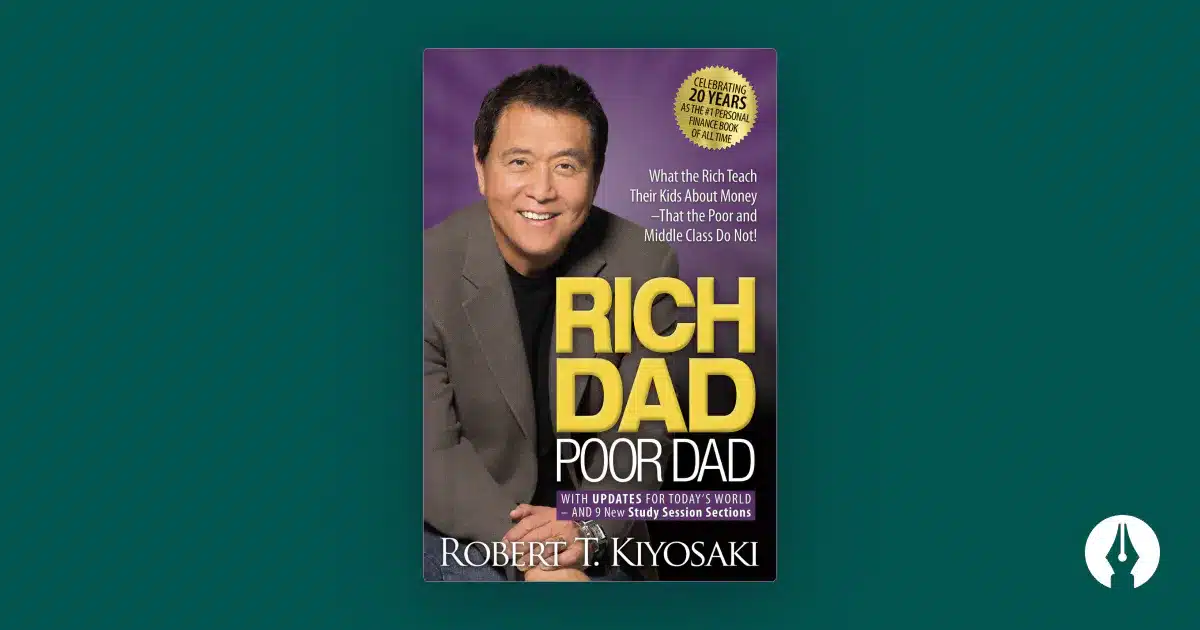

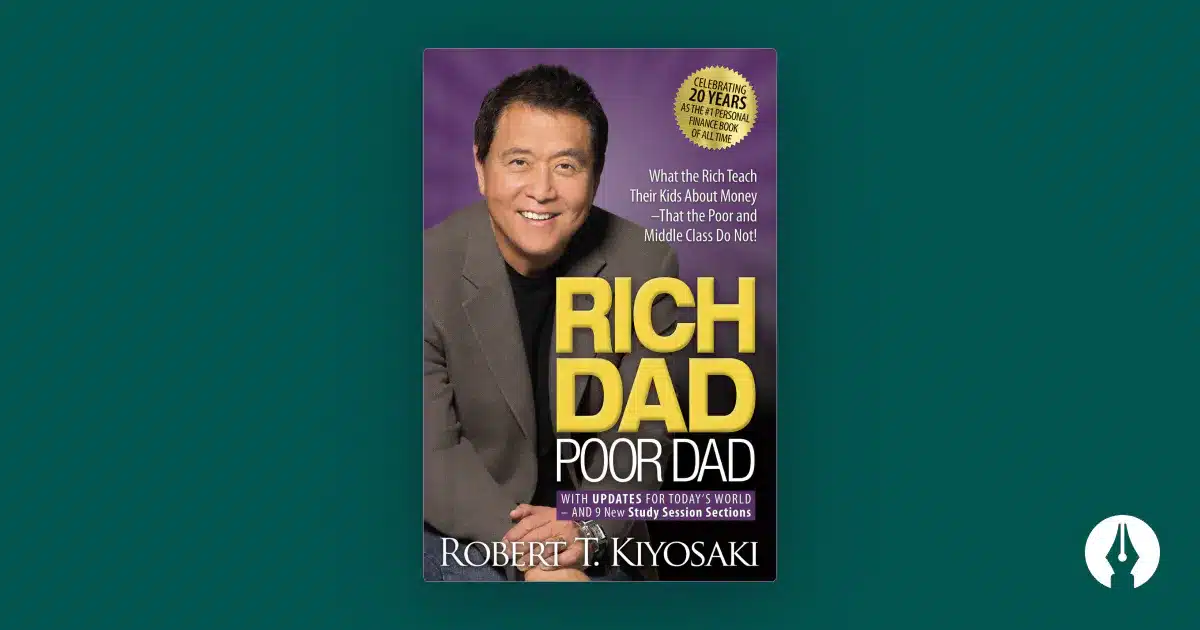

Rich Dad Poor Dad Summary (Review & Book Notes)

A book that will make you rethink the concept of money and how to create wealth. You’ll be inspired by simple stories of acquiring assets and paying yourself first.

The moment you understand that you’re responsible for creating wealth for yourself, you’ll never be the same.

Biggest lesson: you must know the difference between an asset and a liability, and buy assets.

Rich Dad Poor Dad is one of the most popular personal finance books of all time.

It was the beginning of the personal finance revolution, inspiring millions of people worldwide to achieve their financial freedom.

Author Robert Kiyosaki, an entrepreneurial icon and investor, challenges and equips people to take control of their financial future.

He shares his story of growing up with two fathers – one his real father, and one his father’s best friend, his rich dad.

| Author | Robert T. Kiyosaki |

|---|---|

| Publication year | 1997 |

| Category | Business & Money |

| My rating | ⭐️⭐️⭐️⭐️⭐️ |

| Buy on Amazon | Kindle |

I would say that one of the hardest things about wealth-building is to be true to yourself and to be willing to not go along with the crowd.

You become what you study.

Keep your expenses low. Build up assets first.

Always remember: Profits are made in the buying, not in the selling.

Look for people who want to buy first. Then look for someone who wants to sell.

Action always beats inaction.

Money is only an idea. If you want more money, simply change your thinking.

Rich Dad Poor Dad is a short yet must read for anyone trying to become better in business or life.

You can get Rich Dad Poor Dad audiobook for free if you sign up for Audible and grab a 30-day free trial (more than enough to listen this audiobook twice).

🎧 Listen to Rich Dad Poor Dad for free with Audible trial

You can cancel anytime, if you don’t like it.